This article was originally published on Floodlightnews.org and republished here under a Creative Commons 4.0 license.

The lawsuit alleging mismanagement and lies is the latest legal action by shareholders against Florida Power & Light’s parent company.

Jeff Kusmierski’s power bill keeps going up. The cost of cooling his Lee County, Florida home through the subtropical summer has spiked to more than $350 a month. Back in 2022, Kusmierski, 58, decided to purchase some $3,000 worth of stock in NextEra Energy, the parent company of Florida Power & Light, his electricity provider.

“I knew FPL was screwing everybody, I might as well be part of the show,” he said.

But a series of news stories published that summer and fall detailing what critics have called ‘dirty tricks‘ by political consultants working closely with FPL made Kusmierski fear for his investment. So he hired an attorney who used an obscure Florida law to demand access to the company’s internal records. And he got them.

Based in part on those records, Kusmierski filed a lawsuit earlier this month in federal court in Miami against NextEra. His lawsuit became the fourth to claim the company lied to the public and to investors about its political activities aimed at boosting NextEra’s bottom line and cementing its control over the transition to clean energy.

Some of the allegations center around a messy business divorce at Matrix LLC, the Alabama-based political consulting firm hired by FPL that was caught following reporters, paying off digital news outlets, co-opting civil rights leaders and moving secret political funds to help spoiler candidates sway at least five races in Florida in 2018 and 2020.

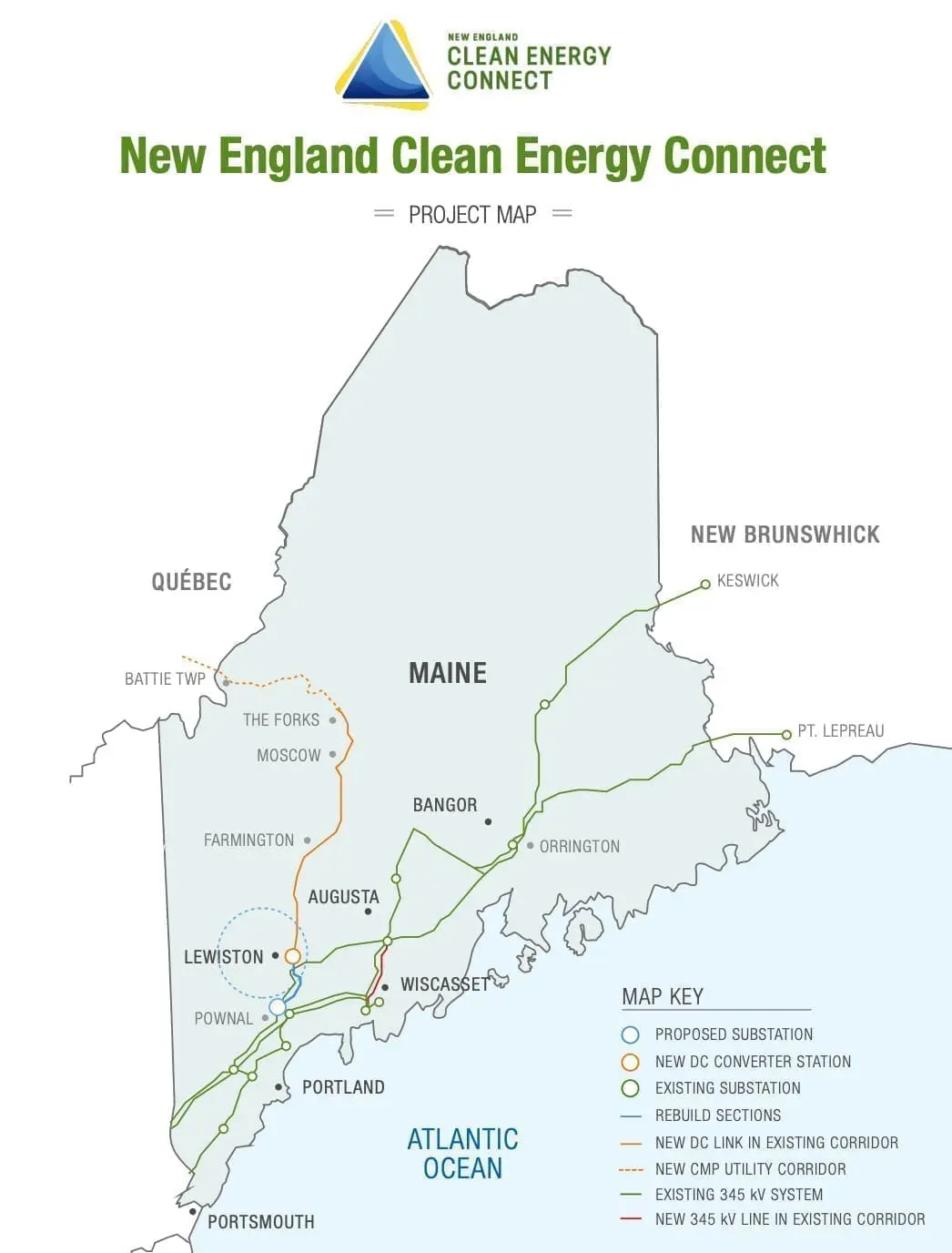

Other claims involve dark money spending against the New England Clean Energy Corridor (NECEC), a transmission line crossing Maine meant to link New England’s power grid to Canadian hydroelectric dams.

“Confidential internal Board-level documents produced to Plaintiff show that … the Board failed to put in place or enforce an adequate governance regime to discourage or root out the kind of below-board political dirty tricks evidenced in the Matrix Memo and the Maine/NECEC affair …” the lawsuit reads.

NextEra Energy did not respond to a request for comment about the litigation. The company has moved to dismiss related securities litigation, arguing that it was transparent with investors about the risks associated with its political activities. This is despite the fact that after a series of news investigations revealed those activities, FPL’s former CEO Eric Silagy abruptly retired, causing one of the largest single-day stock losses in the company’s history.

Kusmierski’s suit is the first to be based on internal NextEra records. It comes amid a generational resurgence of fraud and corruption in the utility sector, as the companies push hundreds of millions of dollars of secret funds into the political system in an effort to capture regulators, influence lawmakers, secure higher profits — and in some cases, avoid transitioning to cleaner sources of energy.

Kusmierski’s lawsuit is also the first to connect FPL’s troubles in Florida to a separate scandal in Maine.

There, political consultants hired by NextEra spent at least $20 million to fight the transmission line from Canada into New England. The spending, which ran afoul of Maine’s ethics laws, resulted in the largest fine ever issued by that state’s ethics commission. If completed, the transmission line would have competed with a nuclear reactor operated by NextEra.

Because Kusmierski’s attorneys had to sign a non-disclosure agreement to gain access to the NextEra records, large parts of the lawsuit were redacted. His attorneys have asked for permission to file the redacted portions of the lawsuit under seal, meaning they may remain secret.

A separate securities lawsuit also filed in South Florida’s federal court could lead to a big payout for stockholders who lost money after the NextEra stock cratered following Silagy’s retirement. Kusmierski’s suit has a different goal: It is a derivative action that seeks to change how the company is run.

If successful, it could claw back millions of dollars of compensation from Silagy, John Ketchum, NextEra Energy’s current CEO, and other members of its leadership. It also could force NextEra to finally start publicly revealing where its political donations go.

“They’re crooks, they’re stealing more money than I can imagine,” Kusmierski said. “That’s the only reason I bought that stock. I knew they were ripping people off.”